Gold vs Property: Where Rich Indians Are Betting in 2025

03 Sep 2025

By 2025, increasing wealth in India means some of the rich population are reconsidering their investment habits in line with the changing economic patterns, fluctuating...

Learn More about Gold vs Property: Where Rich Indians Are Betting in 2025 »

SIP Investment in 2025: Where Should You Really Put Your Money?

18 Aug 2025

If you’ve been thinking about starting an SIP but keep delaying it, you’re not alone. Many of us hesitate — “Is this the right time?...

Learn More about SIP Investment in 2025: Where Should You Really Put Your Money? »

IPO FOMO: How to Spot the Next Nykaa or Zomato Before the Crowd

06 Aug 2025

Over the last few years, the Indian stock market has seen a spate of multiple giant IPOs, including tech-led juggernauts such as Zomato, as well...

Learn More about IPO FOMO: How to Spot the Next Nykaa or Zomato Before the Crowd »

Midcap Magic: Why Young Investors Are Doubling Money in Two Years

01 Aug 2025

As the financial market continues to change, young investors are beginning to find one strategic avenue of investing in midcap stocks. These are the stocks...

Learn More about Midcap Magic: Why Young Investors Are Doubling Money in Two Years »

SIP or Crypto? The Answer Will Surprise You

28 Jul 2025

When it comes to investments, one always argues between the traditional and the modern approach. One such debate is whether to invest in Systematic Investment...

Learn More about SIP or Crypto? The Answer Will Surprise You »

Reliance EV Update 2025: Stocks, Strategy & Surprises

22 Jul 2025

Let’s rewind to a scene just a few years ago: A Reliance AGM, Mukesh Ambani standing tall on stage, dropping bold announcements like firecrackers —...

Learn More about Reliance EV Update 2025: Stocks, Strategy & Surprises »

Reliance Joins the EV Race: Should Investors Gear Up?

21 Jul 2025

A few years ago, the phrase “electric vehicle” felt like something out of a tech expo in California. Fast forward to 2025, and things have...

Learn More about Reliance Joins the EV Race: Should Investors Gear Up? »

EV Stocks in India: Boom or Bubble?

18 Jul 2025

Not too long ago, if someone said “EV,” most people imagined aquirky prototype in a Tesla showroom — not something you’d spot on your...

Learn More about EV Stocks in India: Boom or Bubble? »

Personal Loans Are Cheaper in 2025 — Smart Opportunity or Hidden Trap?

15 Jul 2025

Personal loans gained popularity in India in recent years, and more individuals use them to cover all kinds of services, such as medical emergencies, weddings,...

Learn More about Personal Loans Are Cheaper in 2025 — Smart Opportunity or Hidden Trap? »

Gold vs Property: Where Rich Indians Are Betting in 2025

12 Jul 2025

Let me tell you a quick story.A friend of mine — let’s call him Rohan — comes from a family that has always invested in...

Learn More about Gold vs Property: Where Rich Indians Are Betting in 2025 »

Home First Finance Company Review: Interest Rates, Eligibility, and Benefits

10 Jul 2025

Owning a home is one of the biggest dreams for Every Indian family. But turning that dream into reality often starts with finding the right...

Learn More about Home First Finance Company Review: Interest Rates, Eligibility, and Benefits »

India's New Credit Score Rules: Why Your CIBIL Might Suddenly Drop

09 Jul 2025

In case you have checked your CIBIL score and there has been an abnormal fall in it recently, then rest assured you are not the...

Learn More about India's New Credit Score Rules: Why Your CIBIL Might Suddenly Drop »

2025 IPO Wave Is Here: What Every Indian Investor Must Know

08 Jul 2025

IPO – these three letters can ignite excitement in both seasoned investors and curious beginners. In India, Initial Public Offerings have always created headlines, and...

Learn More about 2025 IPO Wave Is Here: What Every Indian Investor Must Know »

Rental Income Hacks: How to Earn Without Owning Property

07 Jul 2025

The term rental income makes most people conjure up the idea of having their own property—purchasing houses, commercial premises, or apartments and renting them. However,...

Learn More about Rental Income Hacks: How to Earn Without Owning Property »

IPO Season 2025: Which Upcoming IPOs Are Worth the Hype?

07 Jul 2025

2025 is becoming a landmark year in the history of Initial Public Offerings (IPOs), where many great companies are primed to enter the market. With...

Learn More about IPO Season 2025: Which Upcoming IPOs Are Worth the Hype? »

How ESG Funds Are Outperforming in 2025 — And Should You Join?

04 Jul 2025

Amidst the constantly changing environment of investment strategies, Environmental, Social, and Governance (ESG) funds have become a lighthouse to investors who want to achieve not...

Learn More about How ESG Funds Are Outperforming in 2025 — And Should You Join? »

The Silent Crisis: Why Your Mutual Fund Might Be Losing Money Right Now

03 Jul 2025

Most of us invest in mutual funds believing it's the safest and simplest way to build long-term wealth. We set up that SIP, watch those...

Learn More about The Silent Crisis: Why Your Mutual Fund Might Be Losing Money Right Now »

Green Bonds: Are They Really Worth It for Indian Investors?

02 Jul 2025

I’ll be honest. A few years ago, if someone had told me about “green bonds,” I’d probably have zoned out immediately. Bonds always felt boring...

Learn More about Green Bonds: Are They Really Worth It for Indian Investors? »

Switching to Electric? Make Sure Your Bike Insurance Covers These EV Risks!

01 Jul 2025

The EV revolution is certainly catching some traction, especially when it comes to two-wheelers in India! Top brands such as Ola Electric, Ather Energy, TVS...

Learn More about Switching to Electric? Make Sure Your Bike Insurance Covers These EV Risks! »

UPI Goes Global: How India’s Digital Payment System is Reshaping Cross-Border Transactions

30 Jun 2025

India’s booming digital payments ecosystem, built on the Unified Payments Interface (UPI), has made its international debut. What began as a domestic payment option is...

Learn More about UPI Goes Global: How India’s Digital Payment System is Reshaping Cross-Border Transactions »

SBI Cardholders Beware: Free Air Insurance Ends Soon!

30 Jun 2025

Attention SBI Card users! A major change is coming that may affect your travel safety net and your monthly payments. FREE Air Accident Insurance cover...

Learn More about SBI Cardholders Beware: Free Air Insurance Ends Soon! »

Home Loan Rates Crash to 8%! Non-Bank Lenders Take Center Stage in 2025

28 Jun 2025

If you’ve been fantasizing about buying a home, 2025 just got some great news!After the repo rate cut by Reserve Bank of India (RBI)...

Learn More about Home Loan Rates Crash to 8%! Non-Bank Lenders Take Center Stage in 2025 »

Turning the Tide: India Records First Current Account Surplus in Over a Year!

28 Jun 2025

In a remarkable turnaround, India has recorded its first Current Account Surplus (CAS) in more than a year! This is a fantastic development which confirms...

Learn More about Turning the Tide: India Records First Current Account Surplus in Over a Year! »

Why Everyone’s Investing in India’s Smaller Cities Right Now

27 Jun 2025

In the last decade, the Indian real estate business has grown tremendously and changed. Although so far big metropolitan cities have been the main area...

Learn More about Why Everyone’s Investing in India’s Smaller Cities Right Now »

The Wait Is Almost Over: India’s Crypto Guidelines Are on the Way

27 Jun 2025

The crypto investors, exchanges, and enthusiasts in India have been fighting in an uncertain, speculative, and hopeful environment for years. But at last, the mists...

Learn More about The Wait Is Almost Over: India’s Crypto Guidelines Are on the Way »

From Cash to Clicks: UPI Breaks All Records in 2025

26 Jun 2025

India recorded a breakthrough year on the financial technology front and UPI (Unified Payments Interface) has now broken all the transaction barriers in 2025. In...

Learn More about From Cash to Clicks: UPI Breaks All Records in 2025 »

Gold Keeps Shining Even as the Dollar Roars—Here’s Why

26 Jun 2025

The U.S. dollar and gold tend to move contrary to each other. On the one hand, when the dollar becomes stronger, the prices of gold...

Learn More about Gold Keeps Shining Even as the Dollar Roars—Here’s Why »

Smart & Secure: Discover the Best Saving Plan for Your Financial Future

23 Jun 2025

With the economic uncertainty of today, having a solid savings plan is not only a good idea; it’s a necessity. Whether you’re dream planning for...

Learn More about Smart & Secure: Discover the Best Saving Plan for Your Financial Future »

EV vs. Non-EV Car Loan Rates in 2025: Which One Saves You More?

23 Jun 2025

The Indian auto sector is undergoing a sea change, and it is not just what we drive — but the way we are financing it....

Learn More about EV vs. Non-EV Car Loan Rates in 2025: Which One Saves You More? »

Breaking Barriers: The New Fee Payment Model Making Education Accessible to All

21 Jun 2025

Indian education sector has been evolving but better education for all has always been a far fetched dream for many, because of money constraints. Traditional...

Learn More about Breaking Barriers: The New Fee Payment Model Making Education Accessible to All »

Swipe to the Future: How Fintech is Reshaping Digital Payments in India

21 Jun 2025

The financial terrain of India has seen an earthquake in the last decade, with the advent of fintech and digital payments. From a show-off to...

Learn More about Swipe to the Future: How Fintech is Reshaping Digital Payments in India »

India’s Fintech Revolution Meets Cybersecurity: Building Trust in a Digital Age

20 Jun 2025

India’s digital economy is expanding like never before and fintech is at the heart of transforming how its citizens save, borrow, invest and transact. But...

Learn More about India’s Fintech Revolution Meets Cybersecurity: Building Trust in a Digital Age »

RBI Issues Unified Gold Loan Regulations – What Borrowers and Lenders Must Know

20 Jun 2025

The Reserve Bank of India (RBI) has released the "Lending Against Gold and Silver Ornaments and Jewellery Directions, 2025" which in a massive way is...

Learn More about RBI Issues Unified Gold Loan Regulations – What Borrowers and Lenders Must Know »

SIP vs FD in 2025 – Where Should You Really Invest?

19 Jun 2025

We are also inching forward to the year 2025 and now it is the cross point of the investors, i.e., they are caught between that...

Learn More about SIP vs FD in 2025 – Where Should You Really Invest? »

How Gen Z Is Changing the Game: Micro-Investing & Money Smarts

18 Jun 2025

Gen Z isn’t following the accepted script when it comes to money. Born between the mid-1990s and the early 2010s, this digital-native generation is redefining...

Learn More about How Gen Z Is Changing the Game: Micro-Investing & Money Smarts »

How Generative AI Is Revolutionizing the Future of Finance

18 Jun 2025

The finance world is no stranger to innovation, but no trend has rocked thefinancial sector like the rise of artificial intelligence (AI) – and ...

Learn More about How Generative AI Is Revolutionizing the Future of Finance »

India’s Growth Story Continues—But Is the Rupee Holding It Back?

17 Jun 2025

India’s economy is exploding — but its currency is crashing. Big bang GDP growth to counter currency woes in FY26? Let’s break it down.A Tale...

Learn More about India’s Growth Story Continues—But Is the Rupee Holding It Back? »

Growth vs Currency Decoding India's FY26 Financial Projection

17 Jun 2025

India’s economy will expand in FY26 , but the rupee is under pressure. Read more on how this growth-currency split could affect investors, consumers and...

Learn More about Growth vs Currency Decoding India's FY26 Financial Projection »

SIP vs FD: What You’ll Actually Pay in Taxes (2025 Update)

16 Jun 2025

Most of us invest in SIPs or Fixed Deposits hoping for stable returns andfinancial peace of mind. But here’s what often gets overlooked —...

Learn More about SIP vs FD: What You’ll Actually Pay in Taxes (2025 Update) »

Top 5 Best Home Loan Banks in India (2025) – Compare Rates & Features

14 Jun 2025

Millions of Indian dream of buying a home — and in 2025, selecting the right bank for a home loan can make all the difference....

Learn More about Top 5 Best Home Loan Banks in India (2025) – Compare Rates & Features »

Best Credit Cards for Travel & Shopping This Summer – India 2025 Edition

05 Jun 2025

Let’s face it—summer in India isn’t just about the heat.It’s about last-minute travel plans, impromptu shopping sprees, and those irresistible summer sales. Whether you’re flying...

Learn More about Best Credit Cards for Travel & Shopping This Summer – India 2025 Edition »

Fraud-Proof Finance: Outsmarting Hackers Before They Strike

03 Jun 2025

Let’s be real: most of us didn’tgrow up learning how to protect ourselves from hackers. But now, everythingfrom our bank accounts to our...

Learn More about Fraud-Proof Finance: Outsmarting Hackers Before They Strike »

From Zero to Hero: Mastering Your Credit Score for Financial Power

03 Jun 2025

Let’s be honest—credit scores canfeel like one of those adulting things no one really teaches you about, yetthey play a huge role in...

Learn More about From Zero to Hero: Mastering Your Credit Score for Financial Power »

Stock Market’s All-Time High? Here’s What I’m Doing Instead

30 May 2025

The stock market is known for being energetic and hard to predict. It is where many people dream, since fortunes can change in the fastest...

Learn More about Stock Market’s All-Time High? Here’s What I’m Doing Instead »

Will RBI’s New Rules Kill Your Loan Dreams? Here’s the Truth

30 May 2025

Is your loan application at risk because of the latest rules from the Reserve Bank of India (RBI)? Recently, people in finance have been talking...

Learn More about Will RBI’s New Rules Kill Your Loan Dreams? Here’s the Truth »

Lost in Finance Jargon? Here’s How I Finally Made Sense of My Portfolio

29 May 2025

When people talked about their investments—things like mutual funds, NAVs, and so on—I used to look interested and nod. To be honest, I knew none...

Learn More about Lost in Finance Jargon? Here’s How I Finally Made Sense of My Portfolio »

Not Just Stocks & SIPs: 3 Future-Proof Investment Ideas for 2025

29 May 2025

For most Indians, the idea of investing starts with considering stocks and SIPs. Despite these popular approaches, the world of investing is moving rapidly—especially by...

Learn More about Not Just Stocks & SIPs: 3 Future-Proof Investment Ideas for 2025 »

You’ll Regret Ignoring Health Insurance If COVID Hits Your Family Again

28 May 2025

What’s Happening Right Now?Yes, it’s true. COVID-19 is rising again in many parts of India. You may have already seen it on the news, or...

Learn More about You’ll Regret Ignoring Health Insurance If COVID Hits Your Family Again »-1748086891.webp)

These 10 Penny Stocks Could Make You Rich in 2025 – Don’t Miss Out!

24 May 2025

Thinking about investing in the stock market but don’t have a lot of money? Penny stocks might be just what you’re looking for. These are...

Learn More about These 10 Penny Stocks Could Make You Rich in 2025 – Don’t Miss Out! »

Apple का तीसरा कोफाउंडर कौन था जिसने अपनी किस्मत खुद बर्बाद कर दी

23 May 2025

Apple आज दुनिया की सबसे बड़ी टेक कंपनियों में से एक है। हर कोई Steve Jobs और Steve Wozniak का नाम जानता है। लेकिन क्या...

Learn More about Apple का तीसरा कोफाउंडर कौन था जिसने अपनी किस्मत खुद बर्बाद कर दी »

Why the Market Is Up While the World Is Down – India’s Secret Playbook

23 May 2025

While uncertainty in the world’s economy is rising, along with tensions in major regions and the aftermath of the pandemic, India’s market has stayed strong....

Learn More about Why the Market Is Up While the World Is Down – India’s Secret Playbook »

इस आदमी ने दो पिज़्ज़ा के लिए गंवा दिए 1000 करोड़! जानिए पूरी कहानी

23 May 2025

कौन था ये आदमी।करीब 14 साल पहले अमेरिका में रहने वाला एक प्रोग्रामर था। उसका नाम लास्जलो हैन्येच था। ये आदमी कंप्यूटर का काम करता...

Learn More about इस आदमी ने दो पिज़्ज़ा के लिए गंवा दिए 1000 करोड़! जानिए पूरी कहानी »

Middle-Class to Millionaire? How India’s New Export Boom Could Change Your Future

23 May 2025

Recently, India has experienced something incredible — exports from the country are reaching greater heights worldwide. People all over the world are getting more Indian...

Learn More about Middle-Class to Millionaire? How India’s New Export Boom Could Change Your Future »

Is Your Money Safe? How to Prepare for Economic Volatility in 2025

19 May 2025

Financial events such as the change in economic conditions can not only happen in an instant but may also be occurring at a very fast...

Learn More about Is Your Money Safe? How to Prepare for Economic Volatility in 2025 »

Economic Downturn Ahead? Here’s How to Safeguard Your Finances Now

13 May 2025

Headlines are being made once again of an economic slowdown. Inflationary pressures, volatile markets, and global uncertainty are playing out, and that has a lot...

Learn More about Economic Downturn Ahead? Here’s How to Safeguard Your Finances Now »

Top 7 Personal Finance Apps That Will Help You Save Money in 2025

12 May 2025

The field of personal finance management is also following the trends of digitisation, and to be more precise, is actively moving in this direction due...

Learn More about Top 7 Personal Finance Apps That Will Help You Save Money in 2025 »

Can AI Manage Your Money Better Than You? A Look Into the Future of Finance

12 May 2025

In a time where algorithms write poems, make art, and even drive cars, it does not come as much of a shock that artificial intelligence...

Learn More about Can AI Manage Your Money Better Than You? A Look Into the Future of Finance »

The One Crypto Coin That Could Change Your Destiny Forever!

01 May 2025

In the ever-evolving world of cryptocurrency, where Bitcoin and Ethereum have long dominated the headlines, they continue to stand out as some of the best...

Learn More about The One Crypto Coin That Could Change Your Destiny Forever! »

How to Save ₹10,000 Every Month Without Feeling Broke

01 May 2025

Living an enjoyable life as you save money is a noble goal of most people financially planning so as to buy a home. Saving ₹10,000...

Learn More about How to Save ₹10,000 Every Month Without Feeling Broke »

Monthly Budgeting Hacks Every Indian Household Needs

30 Apr 2025

It has become the norm that home finances require some sort of management in the present day for sanity and, mainly, stability. Specifically, when budgeting,...

Learn More about Monthly Budgeting Hacks Every Indian Household Needs »

Is That Loan Offer a Trap? Red Flags You Shouldn?t Ignore

25 Apr 2025

When one faces a financial crunch, a loan may help one at that time, as if it is a saviour. However, not all loan offers...

Learn More about Is That Loan Offer a Trap? Red Flags You Shouldn?t Ignore »-1745404900.webp)

Understanding Stock Market Trends: What Every Investor Should Know

23 Apr 2025

Many investors consider the stock market to be something unknown and difficult to comprehend. It is a place where everything can turn into gold or...

Learn More about Understanding Stock Market Trends: What Every Investor Should Know »

Top Stock Picks for 2025: Where to Invest Your Money

16 Apr 2025

To place the right bets regarding the stock market forecast for the year 2025,it is pertinent to give attention to some constant fundamentals of staking...

Learn More about Top Stock Picks for 2025: Where to Invest Your Money »

How to Build Your Credit Score with the Right Credit Card

15 Apr 2025

It is important to note that one’s credit score plays a significant role in one’s financial background and when seeking loans. Having a good credit...

Learn More about How to Build Your Credit Score with the Right Credit Card »

Property Loans Explained: Points That You Must Understand

15 Apr 2025

The process of purchase of any type of property, whether it is for residential purposes or for investment, requires financing in some way or another....

Learn More about Property Loans Explained: Points That You Must Understand »

The Cost of Care: How to Choose the Right Health Insurance Plan

04 Apr 2025

Modern life can hardly be imagined without health issues, and choosing the right insurance company is a very important and rather challenging task. There are...

Learn More about The Cost of Care: How to Choose the Right Health Insurance Plan »

Investing in Stocks: Tips for Building a Profitable Portfolio

03 Apr 2025

It is good to undertake share deals since they can bring in attractive profits if well managed. Nonetheless, investing in the stock market demands that...

Learn More about Investing in Stocks: Tips for Building a Profitable Portfolio »

Unlocking the Benefits of Fixed Deposits: Your Guide to Safe Savings

02 Apr 2025

Depending on a person’s financial risks and opportunities available, investing has become a way of insulation for future finances. In contrast to other kinds of...

Learn More about Unlocking the Benefits of Fixed Deposits: Your Guide to Safe Savings »

Maximize Your Coverage: Tips for Finding the Best Term Life Insurance Policy

01 Apr 2025

When nothing is certain, protecting your near and dear ones financially is indeed one of the greatest responsibilities one can undertake. Term insurance is one...

Learn More about Maximize Your Coverage: Tips for Finding the Best Term Life Insurance Policy »

Common Mistakes to Avoid When Applying for a Home Loan

26 Mar 2025

Taking a home loan is a somewhat important want in realizing the dream of owning a house. Nevertheless, the process of obtaining mortgage applications can...

Learn More about Common Mistakes to Avoid When Applying for a Home Loan »

First-Time Car Buyer?s Guide to Getting the Best Loan Terms

21 Mar 2025

Purchasing a car for the first time is one of the most memorable moments in a man’s life, but it can be very stressful, especially...

Learn More about First-Time Car Buyer?s Guide to Getting the Best Loan Terms »-1742464356.webp)

Hidden Fees in Car Loans: What You Need to Know Before Signing

20 Mar 2025

Car ownership is one of the most critical milestones in the lives of many people, but loan agreements for car purchases are very complex. Although...

Learn More about Hidden Fees in Car Loans: What You Need to Know Before Signing »

New vs. Used Car Loans: Which One Saves You More Money?

20 Mar 2025

One of the most important things a consumer has to decide when getting a vehicle is whether to opt for a fresh car or a...

Learn More about New vs. Used Car Loans: Which One Saves You More Money? »

Bad Credit? No problem! How to Secure a Car Loan with a Low Credit Score

19 Mar 2025

It may be a herculean task to find an auto financing company, especially when you do not have a great credit score; nevertheless, it is...

Learn More about Bad Credit? No problem! How to Secure a Car Loan with a Low Credit Score »

How to Decide Between Scholarships and Loans for Education Funding

19 Mar 2025

This can be considered one of the biggest barriers to education: financing one’s education at a higher level. Scholarships, on one hand, and loans, on...

Learn More about How to Decide Between Scholarships and Loans for Education Funding »

Difference B/w secure personel loan and unsecure personal loan

18 Mar 2025

Personal borrowings are one of the most prevalent products in India’s consumer credit market due to the growing need for funding various personal requirements that...

Learn More about Difference B/w secure personel loan and unsecure personal loan »

Master Your Money: Expert Tips for Financial Freedom in 2025

17 Mar 2025

It is the desire of any person to be financially independent; however, to make this dream come true, one has to plan, work hard, and...

Learn More about Master Your Money: Expert Tips for Financial Freedom in 2025 »-1741843186.webp)

When Should You Apply for a Credit Card?

13 Mar 2025

Credit cards can be considered as more than just plastic cards in the financial industry of the present day. They are a step towards financial...

Learn More about When Should You Apply for a Credit Card? »-1741757726.webp)

How to Avoid High Interest Rates on Credit Cards

12 Mar 2025

In an economy like the Indian economy, the status of credit cards is changing to become the medium of easy and speedy transactions and to...

Learn More about How to Avoid High Interest Rates on Credit Cards »

Recurring Deposit Interest: How to Get the Best Returns on Your Savings

11 Mar 2025

Recall that RD is very sensible for those willing to save a certain amount of money regularly while earning reasonable interest on the accounts. It...

Learn More about Recurring Deposit Interest: How to Get the Best Returns on Your Savings »

Invest Smartly in Gold Bond Investment with Government Gold Bonds

06 Mar 2025

During today’s rapid economic instability, risks, and unpredictable market prospects, the presence of stable, tangible, fixed assets in a business has become even more relevant....

Learn More about Invest Smartly in Gold Bond Investment with Government Gold Bonds »

Apply Online for an Instant Personal Loan

06 Mar 2025

In the present era, when everything is time-bound and comes with a lot of expectations, the financial needs are also unpredictable and need instant solutions....

Learn More about Apply Online for an Instant Personal Loan »

Finding Cheap Personal Loans along with the Best Bank and Competitive Interest Rate

05 Mar 2025

While most people are acquainted with the fact that, in today’s world, a financial emergency can occur at any instance. If you need your car...

Learn More about Finding Cheap Personal Loans along with the Best Bank and Competitive Interest Rate »

Secure Your Future with Single Premium Endowment Life Insurance Plans

05 Mar 2025

For the people and the families nowadays, to be financially protected has become one of the main desires. To move any building construction, this is...

Learn More about Secure Your Future with Single Premium Endowment Life Insurance Plans »

Maximize Business Efficiency with the Best Corporate Credit Cards

04 Mar 2025

Managing a business brings distinct challenges that need to be addressed. Tracking company expenses while managing funds needs constant effort. Companies find it simpler to...

Learn More about Maximize Business Efficiency with the Best Corporate Credit Cards »

Get Personal Loans Online : Instant Pre Approval At Attractive Interest Rates in India

04 Mar 2025

Today, personal loans have become almost a necessity for the people who are in need of quick cash and for various instances like weddings, medical...

Learn More about Get Personal Loans Online : Instant Pre Approval At Attractive Interest Rates in India »

Easy Mudra Shishu Loan Documents Required and Low Interest Rate

31 Jan 2025

Mudra Shishu Loan scheme has been initiated by the MUDRA, which has been helpful for micro borrowing especially for new start up and other small...

Learn More about Easy Mudra Shishu Loan Documents Required and Low Interest Rate »

What Should Be the Ideal Repayment Tenure for Two-Wheeler Loans

25 Jan 2025

Bike loans are among the most popular types of loans that help people manage their transportation needs. It provides an opportunity to have a motorcycle...

Learn More about What Should Be the Ideal Repayment Tenure for Two-Wheeler Loans »

How Is AI and Personalized Pricing Shaping Consumer Needs in Banking?

23 Jan 2025

Thanks to the development of artificial intelligence, banking industries are being revolutionized in a very significant way. One key change is customers pay more than...

Learn More about How Is AI and Personalized Pricing Shaping Consumer Needs in Banking? »

The High Rental Yield Cities of India for Getting Bigger Returns

18 Jan 2025

The Republic of India is the seventh largest country in the world by land area and in the past decade, the country’s real estate sector...

Learn More about The High Rental Yield Cities of India for Getting Bigger Returns »

Why You Should Choose Term Life Insurance for Winter Protection

16 Jan 2025

With the temperature getting colder along with the short days, winter has arrived and with it the onset of the Christmas holidays, as the mood...

Learn More about Why You Should Choose Term Life Insurance for Winter Protection »

Some of the Best Strategies for Ordering the Right Car Insurance in 2025

15 Jan 2025

Buying the right car insurance policy in 2025 is not an easy process. In the insurance market, there are so many companies and types of...

Learn More about Some of the Best Strategies for Ordering the Right Car Insurance in 2025 »

Essentials of Endowment Plans: An Exploratory Study

14 Jan 2025

Life has many unpredictable things it can throw at you and it becomes an obligation we live by to ensure the financial security of dear...

Learn More about Essentials of Endowment Plans: An Exploratory Study »

How Capital Guarantee Plans Would Save Your Money

13 Jan 2025

Most of us don’t want to see our money flushed down the drain or fail to meet our needs in the future. Another option is...

Learn More about How Capital Guarantee Plans Would Save Your Money »

Is a ULIP the Right Choice for Your Future?

11 Jan 2025

Such a situation in the modern world has become critical, and securing our financial status is the key goal nowadays. One effective approach to attaining...

Learn More about Is a ULIP the Right Choice for Your Future? »

Smart Retirement Planning with the National Pension System

10 Jan 2025

The National Pension Scheme (NPS) has emerged as one of the better instruments for the citizens of India to invest in for their retirement. The...

Learn More about Smart Retirement Planning with the National Pension System »

Understanding the VPF Interest Rate and Its Benefits

09 Jan 2025

The Voluntary Provident Fund (VPF) is one of the savings, coupled with tax-saving benefits, that is offered by the Government of India. This is an...

Learn More about Understanding the VPF Interest Rate and Its Benefits »

How to Link Your Jan Dhan Account with Aadhaar

08 Jan 2025

In this modern world, India’s government, under the leadership of Prime Minister Narendra Modi, has come up with several interventions that seek to enhance the...

Learn More about How to Link Your Jan Dhan Account with Aadhaar »

Essential Tips for a Smooth and Hassle-Free EPF Withdrawal Process

07 Jan 2025

EPF stands for Employment Provident Fund, which is among the most popular retirement schemes in India and provides millions of employees in India the required...

Learn More about Essential Tips for a Smooth and Hassle-Free EPF Withdrawal Process »

How to Start Saving with the Atal Pension Yojana Today

06 Jan 2025

It is accepted that one must save for retirement, but it is not always easy given the current economy for several workers. The various schemes...

Learn More about How to Start Saving with the Atal Pension Yojana Today »

Tips for Managing Your Sukanya Samriddhi Account Effectively

04 Jan 2025

The Sukanya Samriddhi Account, also known as SSA, is a special saving scheme for girls in India piloted by the government. It urges parents to...

Learn More about Tips for Managing Your Sukanya Samriddhi Account Effectively »

Top Benefits of Investing in Kisan Vikas Patra

03 Jan 2025

Expense is part of any financial management process and is an important concept of investment. Investing is one of the many business plans, and every...

Learn More about Top Benefits of Investing in Kisan Vikas Patra »

Can You Withdraw from Your PPF Before Maturity?

02 Jan 2025

The Public Provident Fund (PPF) is a highly popular and trusted instrument of investment in India. Besides being held as a secure means of receiving...

Learn More about Can You Withdraw from Your PPF Before Maturity? »

10 Tips for Maximizing Your Earnings in the Monthly Income Scheme

31 Dec 2024

Monthly income schemes offer a straightforward and effective way to generate a consistent, growing income over time. These investment options are beautiful to individuals seeking...

Learn More about 10 Tips for Maximizing Your Earnings in the Monthly Income Scheme »

How to Calculate Your Returns from a Recurring Deposit

30 Dec 2024

A recurrence deposit is one of the most preferred savings plans where people save money to let them grow gradually. Recurring deposits, on the other...

Learn More about How to Calculate Your Returns from a Recurring Deposit »

Top 5 Benefits of the Senior Citizen Savings Scheme

28 Dec 2024

Retirement is a major life transition through which a person goes from his productive working years to the non-productive post-working years when one mostly lives...

Learn More about Top 5 Benefits of the Senior Citizen Savings Scheme »

Common Mistakes to Avoid When Buying National Savings Certificates

26 Dec 2024

Purchasing NSCs is one of the best ways to invest that any person would wish to undertake with a secure and stable instrument. NSCs are...

Learn More about Common Mistakes to Avoid When Buying National Savings Certificates »

15 Best Saving Plans to Invest in 2025

25 Dec 2024

There is virtually no investment that might not be available in the market, so saving for the future should be wisely done. This article gives...

Learn More about 15 Best Saving Plans to Invest in 2025 »

Essential Tips to Overcome Education Loan Repayment Challenges

24 Dec 2024

To get ready for the future, there is no better option than going for a continuing education today. But it is also a costly process...

Learn More about Essential Tips to Overcome Education Loan Repayment Challenges »

Home-Based Income Made Easy: Unlock Better Investment Strategies

23 Dec 2024

With the current advancements in technology, there are increased numbers of people looking for ways to earn an income online from home. If you are...

Learn More about Home-Based Income Made Easy: Unlock Better Investment Strategies »

Winter Health Tips: Key Insurance Advice for Kids and Seniors

20 Dec 2024

Winter is a beautiful season but it is also a troublesome time, especially for various risky groups such as children and the elderly. This may...

Learn More about Winter Health Tips: Key Insurance Advice for Kids and Seniors »

First Time Homebuyer's Guide to Government Schemes

19 Dec 2024

To most people, buying a house is considered one of the significant accomplishments and investments they would make in their lifetime. However, for first-time home...

Learn More about First Time Homebuyer's Guide to Government Schemes »Why Failing to Renew Your Health Insurance Could Cost You More

17 Dec 2024

Health insurance is an important way to build a financial barrier that helps to protect people from expensive medical bills. However, many people may fail...

Learn More about Why Failing to Renew Your Health Insurance Could Cost You More »

Regular Loans vs. Finance Loans: Which One's Right for You?

13 Dec 2024

What types of loans are available and what can be borrowed from them is something that can impact financial planning and management. Finance loan and...

Learn More about Regular Loans vs. Finance Loans: Which One's Right for You? »

Top Trends and Innovations in the Insurance Industry

12 Dec 2024

Progressing advancements in technology, evolving customer needs, and shifting policy and legislation factors are creating tremendous pressure for insurers to transform at an accelerating rate....

Learn More about Top Trends and Innovations in the Insurance Industry »

Capitalize on Your Savings with Investment Options for Higher Returns

10 Dec 2024

The first strategy towards financial liberty is budgeting, which usually involves putting money aside. Inflation's ever-reducing purchasing power of money means one has to ensure...

Learn More about Capitalize on Your Savings with Investment Options for Higher Returns »

Boss Moves for the Holidays: Manage Payments!

09 Dec 2024

Winter vacationing is all about fun, recreational activities, and making those priceless moments. But for those students who are in the process of repaying their...

Learn More about Boss Moves for the Holidays: Manage Payments! »

Smart Way to Fund Your Studies with Collateral-Free Loans

06 Dec 2024

The costs of tuition and other expenses associated with financing quality education continue to rise, making quality education an expensive option for many students. It...

Learn More about Smart Way to Fund Your Studies with Collateral-Free Loans ».png)

Pancard 2.0 vs. Pancard 1.0: What’s the Difference?

05 Dec 2024

For financial transactions in India, a PAN (Permanent Account Number) is very important for filing taxes, opening a bank account, or investing, and you cannot...

Learn More about Pancard 2.0 vs. Pancard 1.0: What’s the Difference? »

Real Estate Investment Tips: Accelerate Your Wealth Growth

04 Dec 2024

Real estate investment is one of the best means of creating wealth and having a worthy endowment scheme. It also has diversification, unlike stocks and...

Learn More about Real Estate Investment Tips: Accelerate Your Wealth Growth ».png)

When's the Best Time to Get a Property Loan?

03 Dec 2024

Loans against property (LAP) are a popular option for tapping into hefty funds without having to sell your property, understood as a good investment, so...

Learn More about When's the Best Time to Get a Property Loan? ».jpg)

Essential Tips for Sustained Growth in Mutual Fund Investments

02 Dec 2024

One of the most effective ways to grow your wealth over the years is investing with mutual funds. This is an opportunity to spread your...

Learn More about Essential Tips for Sustained Growth in Mutual Fund Investments »

What is stock? how stock works, top 5 stocks for investing.

29 Nov 2024

Shares are also referred to as stocks and are evidence of ownership in a particular firm. Equity means that when you purchase shares, you are...

Learn More about What is stock? how stock works, top 5 stocks for investing. ».png)

The Crucial Role of CIBIL Scores in Securing Your Two-Wheeler Loan.

28 Nov 2024

Two-wheelers are not just a means of transport in India, but they symbolize freedom, ease, and necessity for millions of people. It doesn’t matter if...

Learn More about The Crucial Role of CIBIL Scores in Securing Your Two-Wheeler Loan. »

Winter Wellness Uncovered: What Your Insurance Covers for Flu, Colds, and More

27 Nov 2024

Winter is about warm blankets, fireplaces, holidays, and for some people even flu and colds. Considering that people get sick more often during the winter,...

Learn More about Winter Wellness Uncovered: What Your Insurance Covers for Flu, Colds, and More »

Refinancing Your Home Loan: Why December is the Best Time

26 Nov 2024

At the end of the year, many homeowners may also consider refinancing their home loans. Although refinancing can occur at any time, it is more...

Learn More about Refinancing Your Home Loan: Why December is the Best Time »

Exploring the Rise of Digital Currencies: What You Need to Know in 2025

22 Nov 2024

Digital currencies are an important part of the modern financial landscape and in 2025 we are stepping into them. If you are a veteran investor...

Learn More about Exploring the Rise of Digital Currencies: What You Need to Know in 2025 »

Safeguard Their Future: Why Term Life Insurance is a Winter Must-Have for Families

21 Nov 2024

Winter is a time for intimately warm moments, for getting together with friends and waking up with loved ones for no reason at all. When...

Learn More about Safeguard Their Future: Why Term Life Insurance is a Winter Must-Have for Families ».png)

Buy Property with EMI or Rent and Invest in mutual funds?

20 Nov 2024

One of the biggest decisions people often make is whether to purchase a property and pay monthly EMI or invest in mutual funds while staying...

Learn More about Buy Property with EMI or Rent and Invest in mutual funds? »

what are the different types of loans, which type of loan has the lowest interest rate?

19 Nov 2024

Any business needs to understand that in the currently existing financial world, loans are diverse, and differ in terms of need, candidate’s solvency, and other...

Learn More about what are the different types of loans, which type of loan has the lowest interest rate? ».png)

Which type of investment is best for you is it mutual funds, debt funds, gold investment, or realty?

18 Nov 2024

Generally, there is no simple answer regarding what type of investment to make. Your financial goals, risk tolerance, investment horizon, and preference for personal interests...

Learn More about Which type of investment is best for you is it mutual funds, debt funds, gold investment, or realty? »

Where to invest money to get good returns ?

15 Nov 2024

Growing wealth is an important strategy, and there are so many options to pick from, but where do you start? There are several different, risk...

Learn More about Where to invest money to get good returns ? »

Which is the better option for investing in SIP vs SWP?

14 Nov 2024

When it comes to mutual fund investments, two popular strategies often come up: Systematic Investment Plan (SIP) & Systematic Withdrawal Plan (SWP). Both are ways...

Learn More about Which is the better option for investing in SIP vs SWP? »

Top 10 Best Types of Investments in India (2024 - 2025)

13 Nov 2024

There are several types of investments in India with varying benefits and risks. The selection of this investment would also depend on your requirements. Below...

Learn More about Top 10 Best Types of Investments in India (2024 - 2025) »

New loan rules from RBI: is your bank charge high interest rate ? 5 ways to know that you pay extra

12 Nov 2024

Borrowers would be well advised these days to ensure their banks aren't gouging them on their rate of interest with the Reserve Bank of India...

Learn More about New loan rules from RBI: is your bank charge high interest rate ? 5 ways to know that you pay extra »

Difference Between Flexible Coverage Options, Micro-Insurance, and Peer-to-Peer Insurance

11 Nov 2024

As the insurance industry grows and evolves, it saw that new models of insurance coverage would be created not only to provide more personalized coverage...

Learn More about Difference Between Flexible Coverage Options, Micro-Insurance, and Peer-to-Peer Insurance ».png)

The Pros and Cons of Investing in Digital Currencies

08 Nov 2024

In recent years, digital currencies, also known as cryptocurrencies, have seen widespread use, bringing with them opportunities and risks for investors. On one side, digital...

Learn More about The Pros and Cons of Investing in Digital Currencies »

Consolidating Debt with a Personal Loan: Smart Moves Before the New Year

07 Nov 2024

At the end of the year, people start to think about their financial status and make resolutions for the new year. In case, debt has...

Learn More about Consolidating Debt with a Personal Loan: Smart Moves Before the New Year »

How Digital Currencies Are Reshaping the Global Economy

05 Nov 2024

Digital currencies and tokens such as cryptos or tokens including Bitcoin and Ethereum are creating a new generation in the global economy. Due to the...

Learn More about How Digital Currencies Are Reshaping the Global Economy »

Car Loan Pre Approval: How to Streamline Your Auto Purchase This Winter

04 Nov 2024

Excited to buy a car, but it can also be a bit overwhelming. Getting a car loan pre-approval will make the process smoother. That means...

Learn More about Car Loan Pre Approval: How to Streamline Your Auto Purchase This Winter »

Education Loan Refinance: Is Now the Right Time to Lower Your Rates?

28 Oct 2024

If you own student loans, you could be considering options to minimize your interest payments. One possibility is to think about refinancing your education loan....

Learn More about Education Loan Refinance: Is Now the Right Time to Lower Your Rates? ».png)

Navigating Insurance Claims During the Holiday Season: A Step-by-Step Guide

25 Oct 2024

Once again the holiday season rolls around, a time of joy, celebration, and surprises that didn’t make it into our gain. But this is a...

Learn More about Navigating Insurance Claims During the Holiday Season: A Step-by-Step Guide ».png)

Health Insurance Deadlines: Don’t Miss Out on Critical Open Enrollment Dates

24 Oct 2024

Health insurance is a daunting area to deal with and the issues of time make it even harder to comprehend what one is facing. The...

Learn More about Health Insurance Deadlines: Don’t Miss Out on Critical Open Enrollment Dates »

How to Use Your Holiday Bonus for a Bigger Home Loan Down Payment

23 Oct 2024

Getting a holiday bonus is always a good thing especially if you are planning to purchase a home. Proper utilization of this extra cash can...

Learn More about How to Use Your Holiday Bonus for a Bigger Home Loan Down Payment »

Locking in Low Mortgage Rates: How to Take Advantage of Year-End Offers

22 Oct 2024

With the end of the year approaching many looking to purchase a home or refinance are evaluating their choices in an uncertain mortgage climate. Since...

Learn More about Locking in Low Mortgage Rates: How to Take Advantage of Year-End Offers »

Refinancing Your Home Loan: Why October to December is the Best Time

21 Oct 2024

Towards the end of the year, many homeowners begin to plan for their budgetary plans for the next year. Refinancing a home loan can be...

Learn More about Refinancing Your Home Loan: Why October to December is the Best Time ».png)

Holiday Spending Hacks: Smart Financial Tips for October to December

19 Oct 2024

This is a very important factor to consider particularly during the holiday seasons when people get extra excited to spend. Between gifts, office parties, and...

Learn More about Holiday Spending Hacks: Smart Financial Tips for October to December »

New Tax update from October : What You Need to Know

18 Oct 2024

As October begins, the government of India announces a few important tax updates that every taxpayer should be aware of. All these changes simplify the...

Learn More about New Tax update from October : What You Need to Know »

Top Future-Best Stocks: Long-Term Returns for High-Growth

17 Oct 2024

Buying shares can be exciting and at the same time stressful at the same time especially with the multiple choices that exist in the market....

Learn More about Top Future-Best Stocks: Long-Term Returns for High-Growth »

Digital Currencies: The Future of Money or Just a Passing Trend?

16 Oct 2024

Cryptocurrencies have gained increasing attention recently, with discussions on related issues becoming a popular subject in the financial, technological, and legal spheres. Of course, some...

Learn More about Digital Currencies: The Future of Money or Just a Passing Trend? »

Is It Smart to Combine a Personal Loan and a Home Loan?

15 Oct 2024

In some situations, borrowers consider this strategy, especially when they need to repay several loans at once: they take a personal loan combined with a...

Learn More about Is It Smart to Combine a Personal Loan and a Home Loan? »

Simple Ways to Handle Your Monthly Two-Wheeler Loan Payments

14 Oct 2024

Applying for a loan to buy a two-wheeler is also convenient for increasing the comfort in transportation. However, the issue is always how to manage...

Learn More about Simple Ways to Handle Your Monthly Two-Wheeler Loan Payments »

How CIBIL Scores Impact Your Two-Wheeler Loan Approval

11 Oct 2024

Buying a two-wheeler is a major achievement for most due to the flexibility in transport it provides. However, to complete this buying process, the majority...

Learn More about How CIBIL Scores Impact Your Two-Wheeler Loan Approval ».png)

The Ratan Tata

10 Oct 2024

The TATA Group is India’s topmost and no.1 brand in the history. The TATA is the second name of loyalty, trustworthiness for more than 150...

Learn More about The Ratan Tata ».png)

Journey for securing a Home Loan by Anoop

09 Oct 2024

Owning a home has always been on the wish list of Anoop. After a long span of living in rented apartments, he thought that it...

Learn More about Journey for securing a Home Loan by Anoop »

Unlocking Your Future: Smart Financing with Collateral-Free Private Education Loans

08 Oct 2024

Education is a noble goal, or more accurately, an investment in your future, but textbooks and tuition have become so incredibly expensive. Because of financial...

Learn More about Unlocking Your Future: Smart Financing with Collateral-Free Private Education Loans »

When Is the Best Time to Take a Loan Against Property

07 Oct 2024

It is wise to look for a loan against property (LAP) when you require money for some or other needs like home improvements, business enhancement,...

Learn More about When Is the Best Time to Take a Loan Against Property »

Why a joint home loan might be the smart choice for you

04 Oct 2024

Understanding Fixed vs. Floating Interest RatesAs much as family and housing are concerned one of the greatest challenges is normally the issue of finances. Most...

Learn More about Why a joint home loan might be the smart choice for you »

Crafting the Right Questions for Financial Polls

30 Sep 2024

While choosing the type of the poll, it is important to focus on the fact that polling your audience about their financial habits can be...

Learn More about Crafting the Right Questions for Financial Polls »

Understanding Your Target Audience: Polling on Finance Habits

27 Sep 2024

Understanding your target market is always vital in today’s world, especially when running a business in the financial industry. A wonderful idea on how to...

Learn More about Understanding Your Target Audience: Polling on Finance Habits »

How Big Billion Days & Great Indian Festival Deals Can Maximize Savings for Middle-Class men

26 Sep 2024

Each year, the Big Billion Days and the Great Indian Festival promotions stir up commotion throughout the country. Hence, these occasions are not simply a...

Learn More about How Big Billion Days & Great Indian Festival Deals Can Maximize Savings for Middle-Class men »

Credit and Debit card benefits and discount in Great Indian festival deal Amazon

25 Sep 2024

The Great Indian Festival is the biggest sale that takes place in India each year and is conducted by Amazon. What makes it even more...

Learn More about Credit and Debit card benefits and discount in Great Indian festival deal Amazon ».png)

Credit card benefits and discount in Big Billion days sale Flipkart 27 September.

24 Sep 2024

Every year, the buzz about Flipkart's Big Billion Days Sale 27 September. is completely justified. One cannot refuse to shop with such discounts, special offers,...

Learn More about Credit card benefits and discount in Big Billion days sale Flipkart 27 September. ».png)

How to know the right term insurance cost in india

23 Sep 2024

Term insurance plan is one of the prime financial tools that families need in order to protect their dependents’ future. It pays a sum of...

Learn More about How to know the right term insurance cost in india »

Six New Rules for PPF, Sukanya Samriddhi Yojana, and Other Small Savings Schemes Effective October 1, 2025

20 Sep 2024

Before another year comes to an end, some drastic shifts are in store for the small savings schemes in India like the PPF and the...

Learn More about Six New Rules for PPF, Sukanya Samriddhi Yojana, and Other Small Savings Schemes Effective October 1, 2025 »

Insurances that you need right now 2025

19 Sep 2024

As this world is constantly changing, unpredictable events occur, so it is more critical than ever to have the appropriate insurance protection. Insurance, depending on...

Learn More about Insurances that you need right now 2025 »

How to save your tax liability and increase your savings

18 Sep 2024

Many people find taxes to be a nuisance, but this is something that can be avoided or paid with a substantial amount less. This is...

Learn More about How to save your tax liability and increase your savings »

Simple Tips for Setting Financial Goals and How to Achieve Them

17 Sep 2024

Budgeting is perhaps one of the most effective strategies of regaining financial control in that it involves setting of financial goals. No matter if you...

Learn More about Simple Tips for Setting Financial Goals and How to Achieve Them »

At what age you should start investing for retirement planning?

13 Sep 2024

Retirement planning is one of the most important ways of preparing for the future financially. Many people often wonder, "When should I start investing for...

Learn More about At what age you should start investing for retirement planning? »

Thematic vs Sectoral funds: Best investment strategy is for you

12 Sep 2024

The Thematic and Sectoral funds are both types of equity mutual funds, but they differ in their focus, and approaches to investment. Let’s breakdown them...

Learn More about Thematic vs Sectoral funds: Best investment strategy is for you ».png)

Getting Started with Investing Essential Tips for New Investors

11 Sep 2024

To many people, investing can sound quite challenging; however, it is one of the best plans to create wealth and build a financially healthy future....

Learn More about Getting Started with Investing Essential Tips for New Investors »

How to Pay Off Credit Card Debt Fast: Straightforward Strategies That Work

10 Sep 2024

How to Pay Off Credit Card Debt Fast: Straightforward Strategies That WorkA credit card, although it is such a convenience to have, can keep you...

Learn More about How to Pay Off Credit Card Debt Fast: Straightforward Strategies That Work ».jpg)

When is a good opportunity coming for investing in the Indian stock market?

09 Sep 2024

Leveraging in the Indian stock market is also perceived as a channel towards generating high profits in the distant future. However, capturing it at what...

Learn More about When is a good opportunity coming for investing in the Indian stock market? »

Simple Budgeting Tips for Beginners

04 Sep 2024

Beginning a budget can make some individuals feel overly complicated due to the following reasons: While it is possible to start a budgeting process from...

Learn More about Simple Budgeting Tips for Beginners »

Compare Personal Loan Interest Rates: All Banks in One Place

03 Sep 2024

When applying for a personal loan, it is equally important to consider and compare the interest rates charged. The numerous banks currently in operation proposing...

Learn More about Compare Personal Loan Interest Rates: All Banks in One Place »

Best Car Finance Deals in Noida: Get Approved Fast

30 Aug 2024

Searching for the right car finance deal in Noida is significant if one is interested in a brand new car besides, used cars are a...

Learn More about Best Car Finance Deals in Noida: Get Approved Fast »

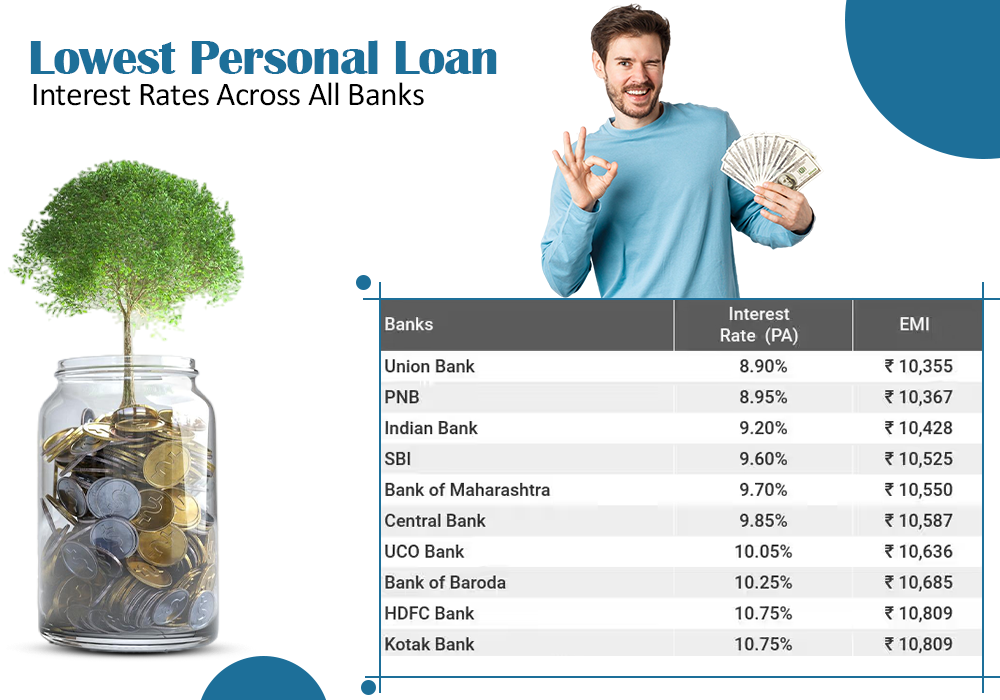

Lowest Personal Loan Interest Rates Across All Banks

29 Aug 2024

Personal loans have become a valuable financial product for those who need to fulfill different purposes, including paying off debt, remodeling a house, or going...

Learn More about Lowest Personal Loan Interest Rates Across All Banks »

Drive Your Dream Car with Easy Car Finance in Noida

28 Aug 2024

It is not a dream anymore to own a car, including in Noida where you can easily get car loans that can be tailored to...

Learn More about Drive Your Dream Car with Easy Car Finance in Noida »

Maximizing Your Car Insurance: The Essential Role of Insured Declared Value (IDV)

23 Aug 2024

When it comes to car insurance, there is a term that holds the key to your peace of mind: increased market shares, insured declared value...

Learn More about Maximizing Your Car Insurance: The Essential Role of Insured Declared Value (IDV) »

Should You Invest? Nippon India MF Launches Nifty 500 Equal Weight Index Fund

22 Aug 2024

Nippon India Mutual Fund has recently come up with new open-ended equity scheme named Nifty 500 Equal Weight Index Fund which will index Nifty 500...

Learn More about Should You Invest? Nippon India MF Launches Nifty 500 Equal Weight Index Fund »

Impact on Stock Brokers: SEBI's New F&O Rules

20 Aug 2024

The new rules in the Indian stock market have been formulated by the Securities and Exchange Board of India (SEBI) regarding the trading of Futures...

Learn More about Impact on Stock Brokers: SEBI's New F&O Rules »

Estate Tax: Tax Rates and Who Pays

13 Aug 2024

Estate tax is a tax that is recovered from the estate of an individual upon the occurrence of an unfortunate incident, like death. This tax...

Learn More about Estate Tax: Tax Rates and Who Pays »

Financial Goals for Students: How and Why to Set Them

12 Aug 2024

Budgeting of money involves coming up with some financial targets it is important for students as it creates the base for future stability. Through money,...

Learn More about Financial Goals for Students: How and Why to Set Them ».png)

5 Tips for Getting Approved for a Mortgage

09 Aug 2024

To obtain a mortgage (home loan) is an important milestone on the path to becoming an owner of a house, but an application can become...

Learn More about 5 Tips for Getting Approved for a Mortgage »

Adjustable-Rate Mortgage vs. Fixed-Rate Mortgage: What's the Difference?

08 Aug 2024

Upon selecting a mortgage, before putting a bargain, it is important to distinguish between an adjustable rate mortgage (ARM) and a fixed rate mortgage (FRM)....

Learn More about Adjustable-Rate Mortgage vs. Fixed-Rate Mortgage: What's the Difference? »

Global Market Crash: US Recession Fears Shake Financial Markets from Asia to Crypto

07 Aug 2024

The volatile movements of the global financial markets have recently evoked numerous discussions about a possibility of the U.S. recession that has a domino effect...

Learn More about Global Market Crash: US Recession Fears Shake Financial Markets from Asia to Crypto ».png)

What Are Returns in Investing, and How Are They Measured?

05 Aug 2024

Returns in investing denote the gain or loss of an investment within a given period. These returns are a key measure of an investment's performance...

Learn More about What Are Returns in Investing, and How Are They Measured? »

Home equity loan vs. personal loan: Which is best for Home Improvement?

01 Aug 2024

In the case of home improvement through a loan, you may find yourself confused between A home equity loan or a personal loan. Each of...

Learn More about Home equity loan vs. personal loan: Which is best for Home Improvement? ».png)

Deadline Date for ITR Filing: Will the Government Extend the Last Date?

31 Jul 2024

The Income Tax Return or commonly known as ITR is an important obligation of every taxpayer in India. If the set time is not met...

Learn More about Deadline Date for ITR Filing: Will the Government Extend the Last Date? »

What benefits of Holding Stocks for the Long Term

29 Jul 2024

Stock investment can be a valuable tool for attaining long-term financial prosperity. Thus, there are several merits that one can get out of investing in...

Learn More about What benefits of Holding Stocks for the Long Term ».png)

Budget 2024 A Step Towards Viksit Bharat

26 Jul 2024

Recently Union Budget of the Year 2024 was passed and announced by Finance Minister Nirmala Sitaraman. This time with the theme of Viksit Bharat, it...

Learn More about Budget 2024 A Step Towards Viksit Bharat »

Budget 2024 date & time? Why the Budget announced 2 times in 2024: What’s new in Budget 2024

23 Jul 2024

The Union Budget for 2024 is releasing in two phases overall. One which has been released prior in the month of February on 1st of...

Learn More about Budget 2024 date & time? Why the Budget announced 2 times in 2024: What’s new in Budget 2024 »

Credit Score vs. Credit Rating: What's the Difference?

23 Jul 2024

In any context that relates to finance, there are always concepts like credit score and credit rating mentioned. Though they may appear similar they are...

Learn More about Credit Score vs. Credit Rating: What's the Difference? ».png)

Payday loan vs. personal loan: How to decide what's best for you

22 Jul 2024

It can be quite important when one has to make a choice between a payday loan and a personal loan in case of meeting urgent...

Learn More about Payday loan vs. personal loan: How to decide what's best for you ».png)

What is universal life insurance?

17 Jul 2024

The universal life insurance (ULI) is a type of policy that pays for coverage for the lifetime of the insured, provided that he or she...

Learn More about What is universal life insurance? ».png)

Your step-by-step guide to filing a life insurance claim?

12 Jul 2024

Death is one of the most painful experiences that anyone may encounter in his life. The positive findings are that there are also costs associated...

Learn More about Your step-by-step guide to filing a life insurance claim? »

How Does Car Insurance Work? The Basics Explained

10 Jul 2024

Car insurance is a legal agreement signed between you and the insurance firm and it ensures you are covered against all the expenses that you...

Learn More about How Does Car Insurance Work? The Basics Explained »

Easy Steps to Apply for ITR Online in 2024

09 Jul 2024

Filing your Income Tax Return (ITR) online isconvenient and quite easy now than before. Here is the detailed procedure thatwill assist you to...

Learn More about Easy Steps to Apply for ITR Online in 2024 »

How Online Mutual Funds Investment is good for investing? Mutual Funds Investment Planning Guide

04 Jul 2024

Investing in mutual funds is a great decision but haveyou ever thought of investing through online mode? As we are growing and allthe...

Learn More about How Online Mutual Funds Investment is good for investing? Mutual Funds Investment Planning Guide ».png)

7 Benefits of Mutual Funds Investment

03 Jul 2024

Planning to invest in mutual funds? Well, it’s a gooddecision as investing your money is a smart move if you want to build your...

Learn More about 7 Benefits of Mutual Funds Investment ».png)

The Best Performing Mutual Funds in India

01 Jul 2024

Planning to invest in mutual funds but confused thatwhich one are the best? Don’t worry! Financenu is here to the rescue. Investingin mutual...

Learn More about The Best Performing Mutual Funds in India ».png)

How Real Estate Investment is a good option for future investing

21 Jun 2024

Planning about real state investment? Well, it is agood idea to save your money and plan your future. But the question arises how? Real...

Learn More about How Real Estate Investment is a good option for future investing » (1).png)

How to Invest in Mutual Funds Online

12 Jun 2024

Thinking of Investing your money in mutual fund investment ? Well investing your money in Mutual Funds Investment Planning can be a great way of...

Learn More about How to Invest in Mutual Funds Online » (6).png)

Empowering Dreams: Udyogini Yojana Explained

04 Jun 2024

The Udyogini Yojana is a laudable program that aims at providing financial assistance to women to help them start or expand their businesses. Popularly known...

Learn More about Empowering Dreams: Udyogini Yojana Explained ».png)

How to Choose the Right Car Insurance Policy

03 Jun 2024

A car insurance policy is a necessity especially if you are a car owner and hence selecting the right car insurance online can be a...

Learn More about How to Choose the Right Car Insurance Policy » (1).png)

Mutual funds vs stocks: Which one is Superior?

29 May 2024

As individuals who would like to put their money in the market, there are two primary instruments through which they can do this which are...

Learn More about Mutual funds vs stocks: Which one is Superior? »

Which Health Insurance Plans Offer the Best Coverage

23 May 2024

The decision about health insurance plans can often be hard as there are many options to choose from. These are some of the top health...

Learn More about Which Health Insurance Plans Offer the Best Coverage ».png)

How a health insurance plans for family Can Keep You Out of Trouble

21 May 2024

Thinking about health insurance plans for family is a good idea because it means that your family is safe and comfortable. It is a really...

Learn More about How a health insurance plans for family Can Keep You Out of Trouble » (1175 x 925 px).png)

7 Tips for Selecting the Best Health Insurance Plan

20 May 2024

Selecting the insurance plan is no less than a demanding task, but, it's a significant step in the direction of covering your and your family’s...

Learn More about 7 Tips for Selecting the Best Health Insurance Plan ».png)

Exploring Top Banks' Personal Loan Schemes and Offers

09 May 2024

The banking sector provides a broad spectrum of grounded Personal Loan Interest Rates 2024 options which are made quite attractive by the competitive rates and...

Learn More about Exploring Top Banks' Personal Loan Schemes and Offers ».png)

Top Best Debit Card Services in India

08 May 2024

In this digital era, having an efficient debit card becomes a necessity for managing a list of expenditures and processing a cashless payment richly. In...

Learn More about Top Best Debit Card Services in India »

Oops! Missed Your Home Loan EMI? Here's Your Survival Guide

07 May 2024

Smoothly you are driving and all of a sudden you run into a pothole - a skipped home loan EMI. We all know the feeling...

Learn More about Oops! Missed Your Home Loan EMI? Here's Your Survival Guide ».png)

Top Home Loan Banks in India: Choosing Between Floating and Fixed Interest Rates

02 May 2024

The process of choosing Best home loan bank in India or owning a home is an exciting experience though it should be aware when it...

Learn More about Top Home Loan Banks in India: Choosing Between Floating and Fixed Interest Rates »

Top 5 Best Home Loan Banks in India 2025 for Home Loan

01 May 2024

Best Home Loan Banks in India is a prime concern and in 2025, India comes with myriad options to fulfil your needs. Enough speculation on...

Learn More about Top 5 Best Home Loan Banks in India 2025 for Home Loan »

Best Home Loan Bank in India with Low EMIs of ₹834* per lakh.

30 Apr 2024

Let's know about Best Home Loan Bank in India.HDFC Bank, takes the front seat being acclaimed for its pledge to not just offer easily affordable,...

Learn More about Best Home Loan Bank in India with Low EMIs of ₹834* per lakh. ».png)

How to Choose an Ideal Debt Mutual Fund?

29 Apr 2024

If you are looking to invest in Debt Mutual funds then it is the right investing option for those who want predictable income and less...

Learn More about How to Choose an Ideal Debt Mutual Fund? »

Top 5 Reasons you might want to Avoid Using a Debit Card

25 Apr 2024

Using a credit card or alternative payment methods might offer better security and financial flexibility in such scenarios while using a debit card as it...

Learn More about Top 5 Reasons you might want to Avoid Using a Debit Card ».png)

5 Key Factors to Consider When Buying Car Insurance

23 Apr 2024

Securing the car insurance that fits is analogous to providing a suitable song for your automotive trip; it needs to be tailored to your requirements...

Learn More about 5 Key Factors to Consider When Buying Car Insurance »

Funding Your Dream Vacations with Mutual Funds!

22 Apr 2024

Do you imagine ocean waves crashing while you finish your margarita, or do you picture yourself in some distant land admiring centuries old artefacts? Well,...

Learn More about Funding Your Dream Vacations with Mutual Funds! »

Loan against Property documents required?

18 Apr 2024

Borrowing a loan against property in India by pledging your real estate not only allows you to utilize the assets you already have as collateral...

Learn More about Loan against Property documents required? »

Top 9 Education Loan with low interest rates in India

16 Apr 2024

An education loan is a unique financial product that enables a student to fulfill his/her educational dreams and acquire funds required to pay fees, accommodation,...

Learn More about Top 9 Education Loan with low interest rates in India ».jpg)

What are the KYC norms for Opening a Demat Account?

15 Apr 2024

Just as setting sail on a voyage is for sea travellers, opening a Demat account is like a sailing trip for the potential investor who...

Learn More about What are the KYC norms for Opening a Demat Account? »

Demat Accounts: Can You Dive In Without a PAN Card?

12 Apr 2024

Now, you are all excited about stock trading and can't wait to dive into this amazing world, but you still don't know how to start,...

Learn More about Demat Accounts: Can You Dive In Without a PAN Card? »Popular Categories

Popular Blog Posts

Demat Accounts: Can You Dive In Without a PAN Card?

12 Apr, 2024

What are the KYC norms for Opening a Demat Account?

15 Apr, 2024

Loan against Property documents required?

18 Apr, 2024

Funding Your Dream Vacations with Mutual Funds!

22 Apr, 2024

5 Key Factors to Consider When Buying Car Insurance

23 Apr, 2024

How to Choose an Ideal Debt Mutual Fund?

29 Apr, 2024